Tax havens ready to share info: Govt

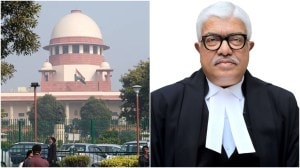

An 18-page affidavit titled Joining Global Crusade against Black Money of the Ministry of Finance in the Supreme Court says tax havens have agreed to end.

An 18-page affidavit titled Joining Global Crusade against Black Money of the Ministry of Finance in the Supreme Court says tax havens have agreed to end banking secrecy and will share information even at the cost of relaxing their own domestic interest.

This means that tax havens would share banking information on black money hoarders strictly for tax purposes even if their banking laws take a backseat. The government calls the arrangement Tax Information Exchange Agreement (TIEA). The report was filed on February 9,2011 after relentless questions from a Bench of Justices B Sudershan Reddy and S S Nijjar about the steps taken by the government to tackle the problem of black money/illicit funds lying abroad belonging to Indian citizens.

As a consequence of the initiative and pressure brought to bear by India,many tax havens have now agreed to end banking secrecy. In addition,the principle of domestic interest while exchanging information for tax purposes is also being relaxed, the affidavit filed by Anoop Kumar Srivastava,Joint Secretary,Department of Revenue,Ministry of Finance,stated.

The TIEAs,the government says,have swept aside the mandatory principle of domestic interest under which a foreign country need not provide information to a country requesting it unless the offence under investigation is an offence there too.

The affidavit said the government has already completed negotiations of TIEAs with 10 countries,namely Bahamas,Bermuda,British Virgin Islands,Isle of Man,Cayman Islands,Jersey,Monaco,St Kitts and Nevis,Argentina and Marshall Islands. The Cabinet has already approved eight of these agreements,it added.

But on the flip side,in major countries like Switzerland and Germany,TIEAs do not have an independent existence,but is only a miniscule part of Double Taxation Avoidance Agreement (DTAA).

In Switzerlands case,India is still waiting for the Swiss to ratify an amended DTAA in which there is a broader scope for free tax information sharing between the two countries.

The February affidavit had promised that the ratified DTAA would allow India to obtain banking information as well as information without domestic interest from Switzerland in specific cases for the period beginning April 1,2011.

- 01

- 02

- 03

- 04

- 05