After FM cleared Bhave extension,advisor stepped in to roll it back

Behind the scenes,however,the chain of events was anything but routine

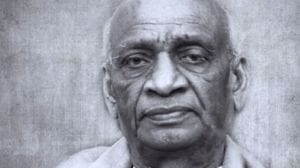

When stock market regulator C B Bhave stepped down as Securities and Exchange Board of India chairman on February 17 this year,it was seen as a routine event,the end of his three-year term. Behind the scenes,however,the chain of events was anything but routine.

Records available with The Indian Express reveal that more than a year before his term was to end,Bhave was cleared for another two years by Finance Minister Pranab Mukherjee. This,after Mukherkee asked for and got a positive recommendation from then Finance Secretary Ashok Chawla on his performance.

Sources said a section in the Finance Ministry had concerns regarding Bhaves earlier stint with National Securities Depository Ltd (NSDL) and his very public spat with Multi-Commodity Exchange of India Ltd (MCX),an electronic exchange that offers trading services in commodities.

But after the Finance Ministry formally wrote to Bhave seeking his consent,Bhave sent a letter to Chawla saying he was willing to accept a two-year extension. Until the intervention of Omita Paul,Advisor to Finance Minister.

It was her note suggesting that no action was needed so early that,records show,was the tipping point: Mukherjee put on hold the process for eight months. The Finance Ministry called back the proposal on tenure extension sent to the Appointment Committee of the Cabinet in January 2010.

In August 2010,or six months before Bhaves term was to end in February 2011,the Department of Economic Affairs again moved a proposal seeking his extension. This time,though,in a U-turn,Mukherjee said action for fresh selection may be initiated.

When contacted,Paul said she would not like to comment.

But sources close to her office said that the NSDL and MCX matters were unresolved issues that had put the Ministry in a spot. When Bhave was CMD of the countrys largest depository NSDL,Sebi served it a show-cause notice in April 2006 for its alleged role in the fake demat IPO scam. After Bhave was appointed the stock market regulator,the Sebi board (excepting Bhave,who recused himself from the decision making) cleared NSDL of all charges in February 2010. But the Supreme Court is still to clear NSDL in the case.

Sebi,under Bhave,did not give MCX Stock Exchange Ltd (MCX-SX),promoted by MCX and Jignesh Shah-founded Financial Technologies Ltd,the licence to offer trading services in equity and derivatives despite repeated requests. MCX-SX was allowed to trade only in currency derivatives since it did not conform to public shareholding norms specified by Sebi in letter and spirit.

Bhave declined to comment on his standoff with the MCX it has taken SEBI to court after waiting for over two years for a green signal from the regulator to offer equity and derivatives trading and the matter is sub judice. Asked about his extension,he confirmed to The Indian Express that he was sounded out and did agree to accept. Its strange that after seeking my willingness (to continue for two more years) nobody got in touch with me on this issue, he said.

- 01

- 02

- 03

- 04

- 05