Global uncertainties will drive the demand for gold

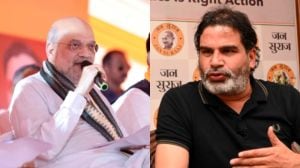

Shivkumar Goel,founder director of Bonanza Portfolio,says that domestic demand and consumption-driven companies would do better and interest-sensitive sectors like real estate and automobiles will be the laggards.

Shivkumar Goel,founder director of Bonanza Portfolio,says that domestic demand and consumption-driven companies would do better and interest-sensitive sectors like real estate and automobiles will be the laggards. In an interview with FE’s Saikat Neogi,he also says gold is trading at 40 times the price of silver,which is on the lower side of the range as the historical average is 50 times. He underlines that prices of gold may rise faster than silver.

Edited excerpts:

With the current level of volatility in the markets,how do you think retail investors should look at asset allocation in the near and medium term?

With the given volatility in the market,particularly due to current situation in Japan and Middle East,the bullion and crude are likely to perform better. Therefore,one should allocate funds in commodities through ETFS (exchange-traded funds) or buying commodities in spot market in demat form.

Which are the sectors you are overweight and underweight on?

The sectors which are domestic demand or consumption-driven and are not much affected in costs by inflation,like gas transmission,entertainment,may do better. With the growth coming back to some of the developed economies,export-related sectors like IT,pharma,textiles,should do better. The underweight positions are suggested for real estate and commercial vehicles sector due to the high interest rates.

Silver has given the highest return last year and even till date this year. How do you explain retail investors looking at silver given the fact that the silver market is not as liquid as the gold market? Do you think any correction in silver prices will erode investors’ wealth faster?

Presently,gold is trading at 40 times the price of the silver,which is on the lower side of the range. The historical average is 50 times. In the near future,it is expected that gold may rise faster than silver. Silver is finding more use in industrial products like electronics and will see some correction,and gold will rise faster now. Even silver ETF is driving up demand for silver in India and now people can buy and store silver in the demat format,and if somebody wants to buy silver,he can now hold the metal in the electronic form. Gold is also becoming a hedge against a lot of factors like inflation and has become an alternative currency. With global uncertainties,the demand for gold will go up and will become a preferred currency.

How should retail investors look at gold ETFs,given the continuing rally in global gold prices?

One may allocate,say,25% of the total investible funds in bullion. Investment in gold through ETF and in silver through spot market in demat form is very convenient for the retail investor.

In the new financial year,what would be the shift in asset allocation of retail investors level?

The Union Budget for 2011-12 continues with a focus on agriculture and as a result,industries handling agriculture inputs like pesticides,seeds,irrigation systems,tractors may see higher allocation.

Do you to see some revival in mutual funds with Sebi allowing fund houses to spend a part of the money collected prior to the ban on entry loads to meet marketing and selling expenses?

Mutual funds continue to be an attractive vehicle for investors who do not have the time and inclination to invest directly. We see the revival in mutual fund mobilisation due to two reasons. First,more and more funds are getting allocated towards equity and are getting invested through the mutual fund route. Second is the wider and easier reach for buying and redemption of mutual fund units through online trading platforms of stock exchanges. With the increased availability of funds for marketing and selling expenses,asset management companies will be able to provide additional push to the marketing and distribution of mutual fund schemes.

What kind of geographical spread in asset allocation you expect to see after the West Asian and North African crises and the quake in Japan?

There would be some shift away from MENA (Middle East and North Africa) as investors run to safety due to political uncertainty. In the case of Japan,the situation is fluid. Significant volatility in the yen has been seen in recent days. World leaders have decided to intervene to prevent runaway appreciation of the yen. The appreciation of the yen could create significant economic challenges for Japan.

- 01

- 02

- 03

- 04

- 05