With Pranab set for Rashtrapati Bhavan,PM may play FM

The fisc: striking similarity between PMs earlier stint as FM & now

With the economy facing strong headwinds and doomsayers likening the current economic situation to that of the early 1990s,Prime Minister Manmohan Singh is widely expected to take charge of the finance ministry after Pranab Mukherjee steps into the race for the Rashtrapati Bhavan.

The PM may take additional charge of the finance ministry to steer the economy out of this mess, a highly placed source told The Indian Express. While a number of other permutations and combinations are doing the rounds,the PM-led charge of the finance portfolio is seen as the most practical solution at a time when the macroeconomic situation,both internal and external,have nosedived.

Some commentators have been warning that the countrys fiscal position is approaching the crisis levels reached in 1990-91. While the fiscal deficit for 1990-91 was well above that for 2011-12. The current account deficit for 2011-12,estimated at around 4 per cent of the gross domestic product (GDP),is also higher than the 3 per cent of GDP it was at in 1990-91,but then foreign exchange reserves are several folds higher currently.

The numbers show that while India is nowhere close to the stage of having to pledge its gold to cover the current account deficit,it needs to be noted that some of the fiscal measures are in worse shape today than they were during the 1990-91 crisis. Subsidies are predicted to keep the fiscal deficit bloated in the current low GDP growth situation. Coincidentally,in 1990-91,India had a GDP growth rate of 5.3 per cent,precisely the number clocked in the fourth quarter of 2011-12.

In recent months,the PM has been taking regular meetings over various macro-economic issues such as rupee depreciation and over all liquidity in the economy. If he steps into the role fully,he is likely to be assisted by his two key deputies Planning Commission deputy chairman Montek Singh Ahluwalia and PMEAC chairman C Rangarajan,who had also stepped in to assist the PM during the international crisis of 2008-09. The PM had taken over additional charge of the finance portfolio in late 2008,when the global financial crisis was at its peak,the person pointed out. This was when then finance minister P Chidambaram had been moved to the ministry of home affairs in the wake of the November 26 Mumbai terror attacks.

In fact,the first two economic stimulus packages that were announced to boost economic growth in December 2008 and then in January 2009 were designed by the PM,who was at that time holding additional charge of finance ministry. The portfolio was handed over to Mukherjee,who was at that time minister of external affairs, in January 2009 when the the PM was to undergo a heart bypass surgery.

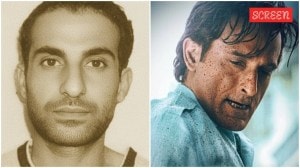

The PM is credited with turning around the economy during his first stint as the countrys finance minister between 1991 and 19996 when he ushered in reforms for liberalisation of the Indian economy. He has also served as the governor of Reserve Bank of India from 1982-85.

The missed opportunity–Finance minister Pranab Mukherjee may have been UPA-IIs favourite troubleshooter,but his three-years at the the helm of affairs in the finance ministry has been ridden with controversies,a bevy of retrograde steps and a certain administrative inertia.

Economy: GDP growth is down to a 9-year low,fiscal deficit is at an all time high,inflation continues to rise though he may not be the only one to blame for the current economic situation,he is being criticised by many for allowing things to reach this stage. All macroeconomic indicators have progressively worsened over his 3-year stint.

Budget Tax Proposals: Mukherjees decisions to go ahead with contentious tax proposals including a retrospective amendment to tax Vodafone-type deals,beefing up of penal provisions in the Customs Act,the introduction of GAAR,along with levies on software sales and onsite services by IT firms,earned brickbats from both global and domestic investors.

Headless financial sector bodies: Appointments in public sector banks and insurance companies,including LIC,have seen delays as well as allegations of favouritism. While LIC got a chairman in DK Mehrotra in June this year after over a years wait,UTI,which has been without a chief for 15 months has restarted the process of appointing a chairman.

Sebi spat: An open spat between former Sebi member KM Abraham and the finance ministry also raised questions over the use of the FMs office. Abraham,a civil servant had written to the PM alleging harassment by income tax officials primarily at the instigation of Mukherjee and his advisor Omita Paul. Equally significantly,the ministry allowed Irda to support guaranteed returns on insurance policies,something the regulators had decided never to allow after the stock market scam of 2001 after clipping Sebis bid through an unprecedented ordinance to regulate unit linked insurance policies.

Financial sector reforms: The finance minister has been unable to reach out to even key allies and build consensus on pending legislations like the PFRDA Bill and Insurance Laws (Amendment) Bill. The GST is still eluding consensus.

Key GoMs and EGoMs headed by finance minister Pranab Mukherjee

Groups of Ministers:

To examine nutrient based subsidy policy and rationalise fertiliser subsidy

For agreement on trade in goods and structural reforms in the CECA between India and Asean

To consider the reports of the Administrative Reforms Commission

To examine situation of the aviation sector,particularly finances of airlines and AAI

To consider issues relating to the World Trade Organisation

To examine a report on paid news and recommend a comprehensive policy on it

To suggest steps to tackle corruption,including the Chawla committee report on natural resources

To consider environmental and development issues relating to coal mining

Empowered Groups of Ministers:

To decide on norms for vacating spectrum and quantum of 3G spectrum to be auctioned

To decide on procurement and management of foodgrain stocks and the minimum support price

To decide on issues of commercial utilisation of gas under NELP

To discuss revised strategy for implementation of NHDP framework and financing

To expedite decisions on all matters concerning Ultra Mega Power Projects

To take policy decisions for the Centre and review progress of all Mass Rapid Transit Systems

To consider under recoveries of oil marketing companies on sale of petrol,diesel,kerosene and LPG

To consider issues relating to Special Economic Zones

- 01

- 02

- 03

- 04

- 05