Why Punjab is burdened with debt of Rs 3.27 lakh crore

In the last twenty years, Punjab’s debt has nearly risen by a multiple of ten, putting immense stress on the state’s finances.

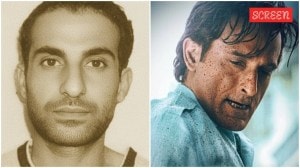

Punjab CM Bhagwant Mann (left) wrote to Governor Banwarilal Purohit, asking for a moratorium on the state's debt for a period of five years. (Express Photo, File)

Punjab CM Bhagwant Mann (left) wrote to Governor Banwarilal Purohit, asking for a moratorium on the state's debt for a period of five years. (Express Photo, File) Punjab Chief Minister Bhagwant Mann wrote a letter to Governor Banwarilal Purohit on Tuesday (October 3), seeking his help in getting a moratorium of five years on the repayment of the state’s burgeoning debt, which is estimated to grow to Rs 3.27 lakh crore by the end of this fiscal.

“With Punjab’s interests in mind, I would urge you to convince the Prime Minister to … accord a moratorium on debt repayment of the state for at least five years. This will provide much-needed relief to the strained financial position of the state and would give some fiscal elbow room to your government to accelerate the growth of revenue and the pace of development,” CM Mann’s letter said.

Just how bad is Punjab’s financial situation? How did things get this bad? What can help?

Punjab spending 20 per cent of annual budget on loan repayments

At the end of the last fiscal, Punjab’s debt stood at Rs 3.12 lakh crore. The government had spent a huge sum on servicing of debt and repaid Rs 15,946 crore as principal, and Rs 20,100 crore as interest on it during the last fiscal. In 2023-24 fiscal, the government would have to pay a whopping Rs 16,626 crore as principal and Rs 22,000 crore as interest, as per its budget estimates.

Chief Minister Mann, in his letter to the Governor, said that his government has alreadyo paid Rs 27,106 crore on debt servicing since March 2022, when it came to power. As per the estimates, 20 per cent of annual budget is being spent on repaying the loans.

In fact, the government has had to borrow money each year to service the debt it is already under. This had put immense pressure on the state, already dealing with a crippling funds-crunch. If things do not change, Punjab’s debt is estimated to cross Rs 4 lakh crore mark in two years.

Two decades in the making, freebies to blame

In 2017, when Congress’s government took over the reins of the state, the SAD-BJP government had left a legacy of Rs 2.08 lakh crore of debt. In five years under the Congress, the state added another Rs 1 lakh crore to its debt.

In fact, over the last twenty years, a period in which both Congress and the Akalis have ruled over the state, the state’s debt has multiplied close to ten times. In 2002, when former Captain Amarinder Singh’s government took over for the first time, the outstanding debt was just Rs 36,854 crore.

‘Freebies’ provided by the state government are a major source of the debt. The power subsidy alone is a major drain on the state exchequer. In the past 26 years, since free power for agriculture was announced by former CM Rajinder Kaur Bhattal in 1997, the state has paid Rs 1.38 lakh crore to farmers, SCs and industry in power subsidies.

Data on the state’s subsidy bill, available with The Indian Express, has revealed that the subsidy bill that started from Rs 604.57 crore in 1997-98 fiscal, crossed Rs 20,000 crore mark by the end of the last fiscal. The subsidy will continue to bleed the state exchequer with the Budget setting aside Rs 20243.76 crore for power subsidy and Rs 547 crore for free transport to women for the current fiscal.

Insurgency-era roots of Punjab’s debt

Punjab’s debt actually dates back to the era of insurgency in the state.

Records show that loans amounting to Rs 5,800 crore was given to the state between 1984 and 1994 for combating insurgency and militancy in the state. In the past, the SAD-BJP government in the state has blamed the Centre for the debt, arguing that it is a legacy of insurgency, when the Centre deployed huge numbers of security personnel and agencies in Punjab, and charged the state for that.

However, the Centre had waived this debt off twice.

How will a moratorium help?

Economists in Punjab have suggested that as a first step, a moratorium on the debt repayment could help the state deal with its unweildy interest payments. Moreover, a special package from the Centre, could help in the revival and rejuvenation of Punjab’s economy. Economists hope that this would build momentum for development in the state and crowd in private investment, especially from the Punjabi diaspora.

At the end of the day, the state needs to send out the right signals, to both its citizens and the foreign investors. Currently, Punjab is transitioning from a “debt-stressed” to a “debt-trapped” state. Changing course at the earliest is imperative, both for Punjab and the Indian economy as a whole.

- 01

- 02

- 03

- 04

- 05